Financial Analyst Academy Program

OBJECTIVES

“ The Chartered Financial Analyst (CFA®) is a prestigious professional designation for finance and investment analysts. The CFA Program includes a series of three exams; Levels I, II, and III .The last paper-based exams will be offered in December 2020; exams in 2021 will be computer-based for all levels. The examination is conducted twice a year every May & August for Level 2 (2021) , and May & November for Level 3 (2021). The examination is conducted four times a year in February, May, August, & November for Level 1. It is facilitated simultaneously worldwide by the CFA® INSTITUTE. “

The rapid growth in the investment and financial worlds has spurred the need to create a standard which investors and employers to rely when dealing with investment and financial professionals. The need for this standard has stimulated the growth in the number of CFA® participants since the CFA® program is known for its high standards for course content, integrity, and professionalism.

CFA® standards are recognized internationally. There are many MBA programs and business schools, but there is only one CFA® designation. Some of the organizations that employ CFA® Charter holders are investment and management companies, consulting companies, investment bankers, insurance, pension funds, banks and other financial institutions.

The demand for CFA® Charter holders is significantly high; in contrast, there are only 100 CFA® Charter holders in Indonesia. There are a number of multinational companies that require at least CFA® Level 1 as a prerequisite for employment for certain professions.

The development of the CFA® Program has been exponential – There are currently 82,000 CFA® Charter holders worldwide. In the United States, the CFA® charter has earned its prestige on the strength of its practical approach and thorough testing on the subject areas covered. Administered for the first time in 1963, the CFA® designation is awarded by the CFA® INSTITUTE, and given to the professionals that fulfill these requirements:

- Passed three exam levels (6 hours per exam) on a consecutive basis and within a minimum of three years.

- A minimum work experience of four years in the field of investment decision-making.

- Adherence to the CFA® INSTITUTE Code of Ethics and Standards of Professional Conduct.

As the first university in Indonesia to have an ISO-9001 Certification, BINUS BUSINESS SCHOOL employs and implements consistent policies and quality targets. As proof of its commitment to develop the CFA® charter in Indonesia, BINUS holds the CFA® preparation program on all levels (Levels 1, 2, and 3) with over 4,000 participants attending the program since 2002.

Why attend the BINUS Financial Analyst Academy Program?

- BINUS BUSINESS SCHOOL – Executive Education has been the Market Leader since 2002

- BINUS BUSINESS SCHOOL – Executive Education is the only provider for Levels 1, 2 and 3 of the CFA® Preparation Program in Indonesia

- The program is taught by CFA® charter holders and faculty members experienced in their area

CFA® designation holders know that intensive preparation is the only way to successfully pass the CFA® examinations .Worldwide passing rates for Level 1, 2, and 3 for June 2008 were 35%, 46% and 53% respectively. In comparison, passing rates in Indonesia are much lower. It is undeniable that a firm grasp of Level 1 concepts will help the candidate prevail on the examination.

COURSE MATERIAL

Introduction to Financial Analyst Academy Class

Participants who have non-business back grounds are offered an Introduction to Financial Analyst Academy Class for one day which comprises of four sessions.

Financial Analyst Academy Level 1 Preparation Details (12 weeks)

| Ethics, Quantitative Methods, and Economics | 11 Sessions |

| Financial Statement Analysis + Corporate Finance | 10 Sessions |

| Asset Valuation + Portfolio Management + Exam Tips | 20 Sessions |

| Practical Skills + Practice Exam + Explanatory | 13 Sessions |

| TOTAL | 54 sessions |

Financial Analyst Academy Level 2 and 3 Preparation

Level 2 preparation emphasizes on Asset Valuation and Level 3 concentrates on Portfolio Management For participants who seek a better understanding of Asset Valuation or Portfolio Management only, they can directly enroll in either Level 2 or 3 without taking the international exam.

Prerequisites in taking the CFA® Exam:

- A Bachelor’s Degree in any field. In line of a bachelor’s degree (S1), the candidate should have at least four (4) years of relevant working experience.

- Submission of a duly accomplished registration form to the CFA® INSTITUTE along with the exam fee

- Consent to conform with the CFA® INSTITUTE Code of Ethics and Standard of Professional Conduct.

| Topic Area | Level 1 | Level 2 | Level 3 |

| Quantitative Methods | 6 – 9% | 5 – 10% | 0% |

| Economics | 6 – 9% | 5 – 10% | 5 – 10% |

| Financial Statement Analysis | 11 – 14% | 10 – 15% | 0% |

| Corporate Issuers | 6 – 9% | 5 – 10% | 0% |

| Equity Investments | 11 – 14% | 10 – 15% | 0% |

| Fixed Income | 11 – 14% | 10-15% | 15 – 20% |

| Derivatives | 5 – 8% | 5 – 10% | 5 – 10% |

| Alternatives Investments | 7 – 10% | 5 – 10% | 5 – 10% |

| Portofolio Management | 8 – 12% | 10 – 15% | 35 – 40% |

| Ethical and Professioanal Standards | 15 – 20% | 10 – 15% | 10 – 15% |

| Total | 100% | 100% | 100% |

Note: These weights (updated November 2023) are intended to guide the curriculum and exam development processes. Actual exam weights may vary slightly from year to year. Please note that some topics are combined for testing purposes.

- Financial Analyst Academy Candidates

- Anyone who wants to improve his/her knowledge of Investment and Finance, including practitioners, professionals, faculty members, and students.

INSTRUCTOR

Staff Members from Professionals and Academicians :

- Dr. Ferdinand Sadeli, MAF, CFA, CPA, FRM (Deputy Group CEO and Group Chief Investment Officer, Sinarmas Land Ltd.)

- Ferry Wong, MBA, CFA (Head of ASEAN and Indonesia Research, Citigroup)

- Franky Venly Kumendong, CFA (Equity Portfolio Manager, Sequis Asset Management)

- Ricky Ichsan, CFA, FRM, PFM, CFP, CFOS, ERMCP, CRMP, CSA, CRP (Managing Director, Ghera Multi Wahana)

- Budi Rustanto, M.M., CFA, FRM, CSA (Senior Analyst – Valbury Asia Securities)

- Santoso Himawan, CFA, FRM (Independent Practicioner)

- Andre Varian, CFA, FRM (AIA Financial – Portfolio Manager)

- Bramantya Egin Pratama, CFA, FRM (Head of Product Development – PT Indo Premier Investment Management)

- Christofer Wibisono, MA, CFA (Director – Wijaya Wisesa Group)

- Andreyoso Sutikno, CFA (Investment Manager – Kendall Court)

- Galvin Batti, CFA (Investment Analyst – Kendall Court)

- Hariyanto Wijaya, CFA, CPA, CFP, CMT (Vice President, Research Department)

- Nathanael Sutanto, CFA (Head of Investment – Heidelberg)

COURSE SCHEDULE

Introduction to Financial Analyst Academy Class

” To help candidates that have non-business background, we will hold an introduction for CFA® class for 1 day on Saturday, January 13 , 2023, from 08.15 am – 05.30 pm (5 sessions). This module is used to give and build some background for candidates in order to adapt with the material.”

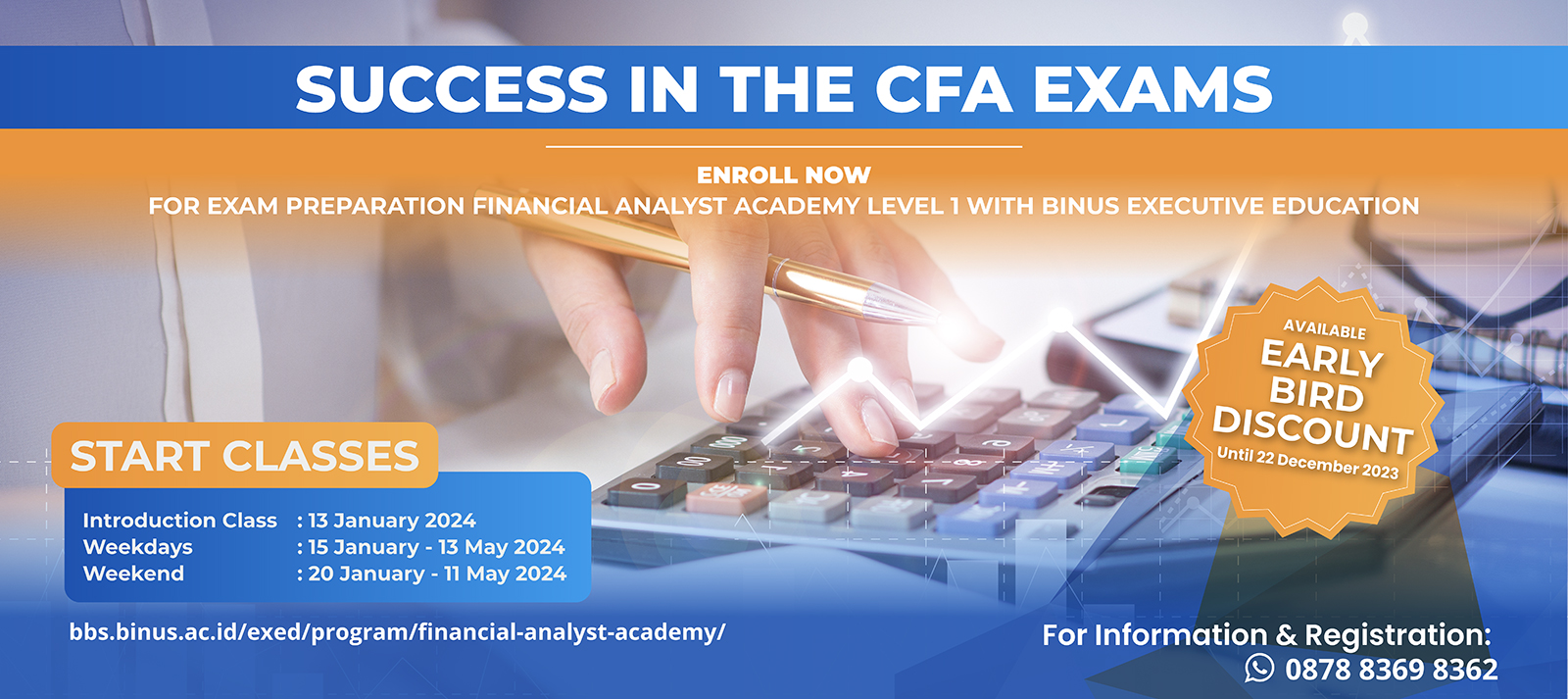

- Available Discount Early Bird 5% until Friday, December 22, 2023

Financial Analyst Academy Level 1 Batch 45

There are 2 classes for your choice:

| Weekdays Class | Weekend Class | |

| Introduction | – | 13 January 2024 |

| Date | – | 20 Jan – 11 May 2024 |

| Day | – | Saturday |

| Time | – | 08.45 am – 05.35 pm |

* The cost includes access to the material in LMS Extra learning portal.

Financial Analyst Academy Level 2

| Weekend Class only | |

| Session | 43 Session Online Class |

| Training schedule | August 2024 |

| Day | Saturday |

| Time | 08.45 – 17.35 WIB (Full Session) |

* The cost includes access to the material in LMS Extra BINUS Executive Education and the KaplanLearn Schweser portal with the features above.

Financial Analyst Academy Level 3

| Weekend Class only | |

| Sessions | 39 Session Online Class (CFA® BINUS) |

| Training schedule | TBA |

| Day | Saturday |

| Time | 08.45-17.30 |

* The cost includes access to the material in LMS Extra BINUS Executive Education and the KaplanLearn Schweser portal with the features above.

COURSE FEE

| Introduction to CFA® | Rp 1.800.000 |

| Financial Analyst Academy Level 1 Training Program | Rp 13.500.000 |

| Financial Analyst Academy Level 1 Training Program + Introduction to CFA® | Rp 14.300.000 |

| Financial Analyst Academy Level 2 Training Program | Rp 9.300.000 |

*Fee includes access to LMS Extra learning portal, course online material, lunch/dinner (on site class only), certificate of attendance, and parking card (on site class only)

|

|

Note :

- Course Fee is nett

- Payment no later than one week before the training program begins.

- Withdrawal or delay in joining the training program no later than 3 days before the training begins with an administration payment of Rp. 100.000.

- No refund for participants who withdraw after the training program begins.

- Participants who have registered cannot be replaced with other participants.

Promo installment 0% for Credit Card:

- BCA : 3 installment

- CIMB Niaga : 6 installment

- BNI : 9 installment

ADDITIONAL PACKAGE

There are three Kaplan Schweser packages you can choose.

| Package | Price | Package Includes |

| Essential | Rp. 6.750.000,- | SchweserNotes™, CFA Mock Exams (4), Checkpoint Exams, InstructorLink, JumpStart, Kaplan Schweser Community, Module Videos, Performance Tracker, QuickSheet, SchweserPro™ Qbank, Masterclass (OnDemand), Schweser’s PassProtection™ |

| Premium | Rp. 8.750.000,- | SchweserNotes™, CFA Mock Exams (6), Checkpoint Exams, InstructorLink, JumpStart, Kaplan Schweser Community, Module Videos, Performance Tracker, QuickSheet, SchweserPro™ Qbank, Masterclass (OnDemand), CFA Review Workshop (OnDemand)*, Schweser’s Secret Sauce®, Schweser’s PassProtection™ |

*updating by KaplanLearn

CONTACT US

Information :

Edina edina.savitri@binus.edu

Oqie oqie@binus.edu

Registration :

Click here for Registration.

Click here to Registration Guidance

*) The CFA® INSTITUTE does not endorse, promote, review, or warrant the accuracy or quality of BINUS BUSINESS SCHOOL – Executive Education or providing CFA® Exam preparation materials or programs, nor does the CFA® INSTITUTE verify pass rates or exam results claimed by such organizations. CFA® and Chartered Financial Analyst are registered trademarks owned by CFA®INSTITUTE. BINUS BUSINESS SCHOOL – Executive Education is not affiliated with the CFA® INSTITUTE and/or its subsidiaries.