Dissertation Examination of Risye Dillianti

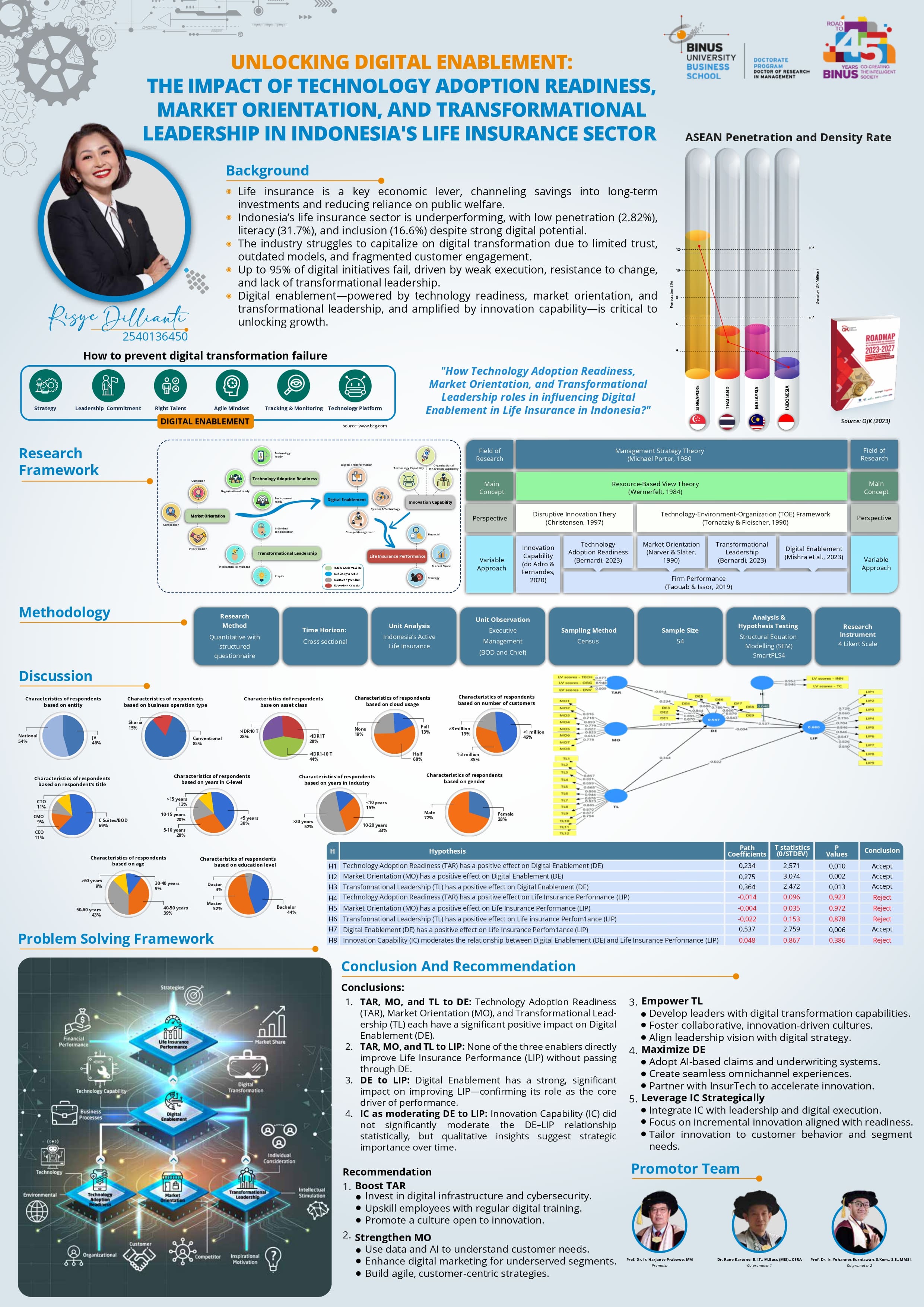

On Tuesday, 2 September 2025, The Dissertation Defense for the Doctor of Research in Management (DRM) program of Risye Dillianti [2540136450], entitled “Unlocking Digital Enablement: The Impact of Technology Adoption Readiness, Market Orientation, and Transformational Leadership in Indonesia’s Life Insurance Sector,” was conducted at the Alam Sutera Campus, Bina Nusantara University.

The dissertation examination was chaired by Prof. Dr. Ir. Harjanto Prabowo, M.M. (Promotor) and attended by the team of promotors and examiners. The promotors consisted of Dr. Rano Kartono Rahim, B.IT., M.Bus. (MIS) (Co-Promotor I) and Prof. Dr. Ir. Yohannes Kurniawan, S.Kom., S.E., MMSI (Co-Promotor II). The board of examiners comprised Prof. Dezie Leonarda Warganegara, Ph.D. (Examiner I), Evelyn Hendriana, S.E., M.Si., Ph.D (Examiner II), and Cyrillus Harinowo, Ph.D (Examiner III).

Dissertation Summary

This study examines how Technology Adoption Readiness (TAR), Market Orientation (MO), and Transformational Leadership (TL) influence Digital Enablement (DE) and, in turn, impact Life Insurance Performance (LIP) in Indonesia. It also evaluates the moderating role of Innovation Capability (IC) within this relationship.

Findings reveal that organizations with strong digital readiness, market responsiveness, and visionary leadership are better positioned to achieve successful digital transformation. However, readiness, market orientation, and leadership alone do not directly enhance performance—they must operate through digital enablement to create tangible outcomes such as improved efficiency, customer satisfaction, and competitiveness. While innovation capability currently plays a limited role, it highlights the need for stronger innovation ecosystems within the life insurance sector.

To strengthen digital transformation, companies are encouraged to invest in robust digital infrastructure, promote continuous upskilling, and build an agile, innovation-driven culture. Enhancing market orientation through data analytics, personalized engagement, and AI-driven insights is essential to meeting evolving customer needs. Leadership development should focus on digital competencies and cross-functional collaboration. Furthermore, leveraging InsurTech partnerships, automation, and data-driven decision-making can optimize customer experiences and operational performance.

Ultimately, digital transformation in life insurance must balance technology and human interaction. Younger, tech-savvy customers prefer self-service platforms, while traditional segments still value personalized, agent-led engagement. A hybrid approach will ensure sustainable adoption and long-term growth.

Author Biography

Risye Dillianti, S.E., MBA, is a seasoned professional with over two decades of experience in the financial services industry, particularly in banking and insurance. A graduate of the Master of Management program at Universitas Gadjah Mada (MMUGM), she currently serves as President Director of PT MNC Life Assurance and Managing Director of MNC Insurance Business Group, leading the transformation and strengthening of MNC Group’s insurance business lines. Risye is deeply committed to advancing Indonesia’s insurance industry, focusing on improving insurance literacy and inclusion through digital innovation and customer-centered business models. She believes that public trust and education are essential foundations for long-term industry sustainability. As a leader, she fosters an agile, collaborative, and accountable organizational culture, emphasizing innovation and human capital development. In her role as Vice Chairperson VI of the Indonesia Fintech Association (AFTECH), she promotes synergy among industry players, regulators, and technology enablers to accelerate the digitalization of financial services. Beyond her professional career, Risye is a mother of two and grounds her leadership philosophy in inclusive values, personal growth, and purpose-driven transformation.

Publication

Her academic journey further reflects her dedication to industry. Her doctoral dissertation and published works showcase her contributions to strategic development in life insurance, especially in the areas of digital enablement, leadership, and market orientation. Selected publications include

- Dillianti, R. (2024). Bridging market orientation and leadership through digital enablement: A strategic model for life insurance success. ResearchGate [(PDF) Bridging market orientation and leadership through digital enablement: A strategic model for life insurance success]

- Dillianti, R. (2024). From readiness to excellence: The role of digital enablement and innovation in life insurance performance [(PDF) From readiness to excellence: The role of digital enablement and innovation in life insurance performance]

- Dillianti, R. (2024). Digital Transformation and Strategic Capability Alignment in the Indonesian Life Insurance Sector. IEEE.