Execution Matters: Delivering Value for Stakeholders

On Saturday, February 4th, 2017, BINUS JWC Campus, Senayan, Jakarta, was so fortunate for having an opportunity to listen to a lecture from Zulkifli Zaini in the MM Executive Guest Lecture Session. Mr. Zaini stands in multiply honorable positions, which as the chairman of Ikatan Bankir Indonesia (IBI), an independent commissioner in Indonesia Infrastructure Finance (IIF), and in PT Triputra Agro Persada. He has countless experiences in the banking world, including in the subject of branch network, operations, IT infrastructures, management of risk, and wholesale product management.

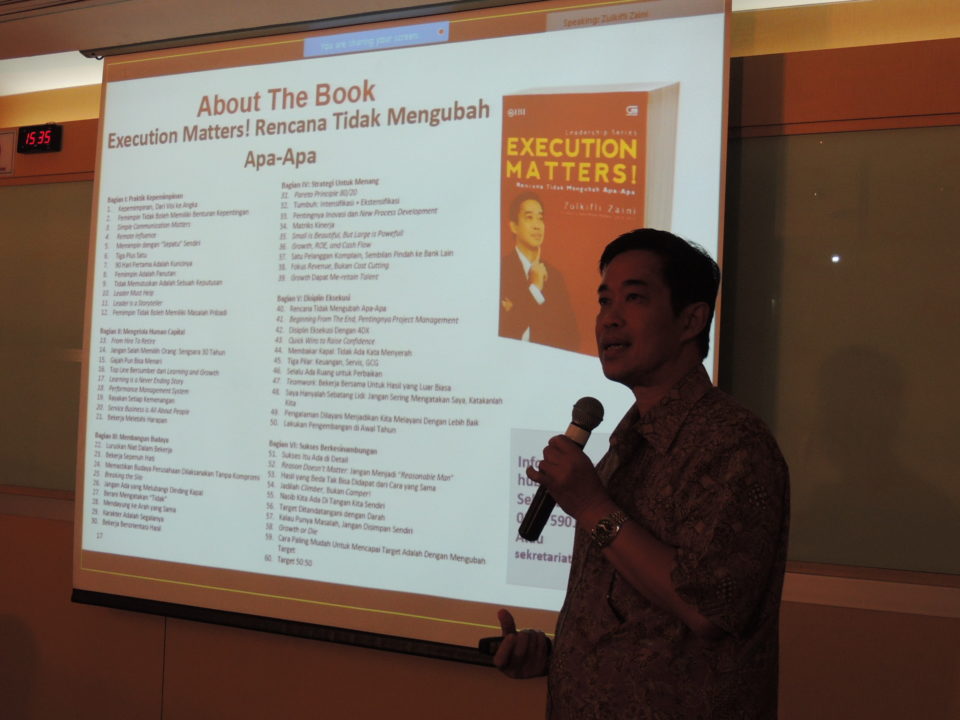

In the lecture, Mr. Zaini explained about winning in business in the terms of leadership, due to the fact that everyone does not want to be a failure. But, one would not reach a victory if one does not move; winning is achieved through performance and leadership is the art of performance. He emphasizes execution is essential; for only to plan will change nothing at all. So, it is very important to do the implementation of a perfect plan that has been made. The perfect plan will not be as perfect as it seems, if it is only a spoken concept.

“It is not the strongest of the species that survive, nor the most intelligent, but the one that is most responsive to change”— Charles Darwin.

However, performing a plan is frankly not as easy as it seems to be. Challenges are always around to prevent the successful of the plan to happen. Everything has its own challenge, including doing a performance. Thousands of years have passed and changes continuously happen, along with the great transformation of the circumstances.

Mr. Zaini took an example of the life of giraffes as an illustration. This tallest herbivore on earth would certainly meet its death, if evolution of its long neck did not happen; to the fact that all trees grow tall and trees are the sources of herbivores’ food. During the unpredictable situation on the business field, which is constantly changing, adapting is the essence of success to overcome the unexpected changes. This natural ability of survival can be used as key of success in leadership performance.

To adapt needs a daring effort to put things at stake; one must do a transformation within in order to adapt. In this situation, unpredictable circumstance is the enemy. Therefore, like a wise man always says, learn your enemy before it conquers you down.

There are actually two factors that have the ability to affecting a change: external and internal. External factors come from outside one’s circle, which means the factors are outsiders that influence ones within. Those factors are the new technologies, customer preferences, changing of economic regulation, government changing, social condition, and macroeconomic condition, whereas, internal factors are merger and acquisition, changing in management division, changing in shareholder, success of the leader, and exodus of the top talented employee. These all factors must be learned deeply, so strategies could be formed as a backup plan.

However, transformation from within is often being avoided because of the high risk, or because of an uncaring attitude that inhibits adaptation, which will lead to failure later on. This subject about failure then catches the interest of many institutions, including Massachusetts Institute of Technology.

Research shows a few reasons that trigger failure: fail to recognize or to adapt to the next challenge, lack of team effectiveness, managers Line do not take the lead, unclear future state, fail to learn lessons from pilot, workforce does not respond to their leaders, lack of shared visions and objectives, no personal commitment of leaders, lack of knowledge of the change, no personal branding, constant fire fighting (arguments), leaders step back at the deployment phase, and initiative fatigue.

To have the audience understood more clearly, Mr. Zaini used a tangible evidence of Mandiri Bank. The bank itself was established in October 2nd, 1998, as a result of the emerging of 4 state-owned banks, which were BDN, BBD, BAPINDO, and Bank Exim.

During the affiliation, there was a restoration in the enterprise. Reconstruction of earning asset, rationalization to the employers, rehabilitates the infrastructure, until recapitalization that was being performed by the government, was being done. Everything was perfect, at first.

However, seven years later, in 2005, Mandiri Bank suffered complex problems, which brought Mandiri Bank to undergo an economic crisis. This devastating crisis was triggered by the degradation of employers’ morality, which caused the downfall of profit and shareholders’ value, also the rising of NPL Gross. This situation was in urgent to be saved. Hence, the management decided to take the risk by executing a transformation. The great recondition of transformation was being done massively within the bank.

The first step for Mandiri Bank is the problems must be identified. The identification gave a result that there were seven problems that caused a crisis came upon Mandiri Bank:

- The rising of Non Performing Loan (NPL) and the high risk of credit.

- The failure of governance, risk management, and operational controlling system.

- The cautious behaviour of the customer to corruption.

- The low profitability (Profit, ROE, ROA, NIM) that is caused by the poor situation of yield recap bonds and fee based income, and the high numbers of NPL, cost of fund, and income ratio.

- The low performance of corporate values, performance culture, and accountability.

- The ineffectiveness of consumer and commercial sales model, branch network, and electronic channel.

- The rising of NPL prevents profits.

Secondly, Mandiri Bank was forced to choose between two options: solely became a large bank in Indonesia or as a regional champion. The tough decision ended up Mandiri Bank to choose the latter, which was accompanied by Dominant Multi-specialist Bank as the strategy. In order to achieve the strategy, once more, there must be a reconstruction on four aspects: culture, business growth, Alliance Strategy, and Controlling NPL.

Due to the poor morality of the employees, the working culture in the Bank must be rehabilitated from the beginning by reconstruction of the organization structure, rearranging the PMS (Portfolio Management Service) planting a high standard of ethics, new implementation of corporate culture, creating a development program of leadership and talent, and adjusting the human resources according to the need.

Meanwhile, the business growth must prioritize the demand of specific customer service by implementing the method of wholesale banking, designing optimal retail networks, engaging the culture of customer service, building a service for lower affluent retail, and growing inorganic through acquisition. On the other hand, Alliance Strategy must be remodeled by specifically focus on development and management and aggressively launch 2 or 3 potential Alliance Programs.

As for the credit issue, controlling the NPL by controlling management of risk and operational was practically needed. This strategy could be done by fixing the degree of NPL, designing and implementing CRM (Customer Relationship Management) based loan monitoring system, raising the effectiveness of credits dealing process, and optimise end-to-end process. In addition, the bank chose to rewrite its vision to: to be most trustworthy and most chosen bank, and dominate the market share revenue, in the percent from 20 to 30 around business field, that advantage Indonesia. So, Mandiri Bank could claim the position as Dominant Multi-specialist Bank and becomes the most well known one in a wide range, including South East Asia.

“Until I came to IBM, I probably would have told you that culture was just one among several important elements in any organization’s make up and success – along with vision, strategy, marketing, financials and the like…I came to see, in my time at IBM, that culture isn’t just one aspect of the game – it is the game” – Lou Gertsner Jr.

To end the lecture, as a reminder, Mr. Zaini strongly emphasized that changing of culture is important in order to achieve the success of the wanted transformation; and aligned culture is supported by strong values that corporation must possess, which are behaviors, symbols, and system.

Behavior is a habit towards a situation that is being done continuously, which will result a custom. Either the leaders or each worker within every existed unit must take part in a good custom that will surely give advantage to the corporation. To create a good custom, daily repetition must be conducted genuinely; leaders must be the ones who direct the workers, since they are the example for the workers. They must care for some aspects, namely paying attention to a regular basis, by measuring the effectiveness and taking control of it all, plan to react over critical incidents and organisational crisis, thinking about resources’ and reward status allocation.

Symbolic action is also needed as a part in an aligned culture. It consists of the rites and rituals of the organisation. For example like designing of physical space, facades, and buildings, telling stories about important events and people, and creating formal statements of organizational philosophy, creeds, and charters.

Last value is system, which its definition is a set of interacting sections with the result that the goal will be achieved. System in a corporation is undoubtedly important, since each part must have clear job desk for the sake of the working process of the corporation. Therefore, a clear organisational structure and procedures must be existed to create a good system.

(Petricella)