MARKET SEGMENTATION IN THE ONLINE CATERING INDUSTRY

By; Tifanny Tandy, SE (Alumni of International Marketing) & Annetta Gunawan, SE, MM (Faculty Member of International Marketing)

With its large population, increasing affordability of the internet and usage of mobile devices, Indonesia has the highest percentage of internet users compared to other Southeast Asian countries. The number of Indonesian internet users grew steadily from 42.2 million to 74.6 million from 2010 to 2013. Netizens – who can be defined as users who spend more than 3 hours a day online – have also grown in number during the same period from less than 20% to more than 40%. Almost half of these netizens were under the age of 30 years, while those above the age of 45 years made up 16.7% of netizens in the country. Most netizens access the web via smartphones (86%) and spend between Rp 50,000 (US $5) and Rp 100,000 (US $10) every month for internet access.(Singapore Post Limited, 2014)

When it comes to devices most frequently used to shop online, the use of mobile phones for online shopping is growing in popularity. Indonesia ranks in the top markets globally for use of a mobile phone to shop online together with The Philippines, Vietnam and Thailand; while all Southeast Asia markets scored above the global average. More than six out of ten consumers (61%) will use their mobile phones most frequently to shop online while more than half (58%) will use their computers. Tablet usage is also gaining traction as a means of accessing online retail sites with more than one third (38%) consumers saying that they will use tablet to shop online. (MiladinneLubis, 2014)

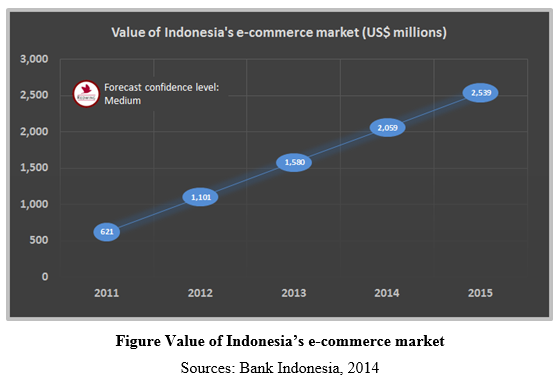

As a result, online Retail Market of Indonesia has undergone profound changes since modern outlets have increasingly replaced wet markets and independent small shops. The online retail market in Indonesia is poised to grow at an unprecedented rate in the upcoming years on the back of factors such as rising internet population, increasing personal disposable incomes, rise in urban population, and lack of shopping malls in tier-2 and tier-3 cities, rise in demand of toy and musical instruments in the country. The protection from government in terms of online payment and grey market is expected to improve the situation of domestic online retailers. (Ken Research, 2015)

This statistic shows retail e-commerce sales as a percent of total retail sales in Indonesia from 2013 to 2014, and a forecast until 2018. In 2013, e-commerce sales accounted for 0.5 percent of all retail sales in Indonesia, this figure is expected to reach 1.4 percent in 2018.

On the other hand, MarkPlus Insight 2015 Consumer Study in Jabodetabek affirms residents on average tend to spend higher on food, compared to other cities. Markplus’ survey including 635 respondents from Jabodetabek reveals as many as 40% respondents spendbetween IDR1 million to IDR1.5 million while up to 18% spend IDR 2 million a month on food expenses.

As many as 37% respondents from the Affluent SEC spend IDR3 million on food, while 33% of the HNW individuals spend as much as IDR 5 million. Jabodetabek residents in general, are also turning more health conscious, as reflected from the survey where up to 36% respondents said they often preferred to eat organic and low-fat foods and drinks. (Priyanka Shekhawat, 2014)

Hence, there’s one aspect that the digitalization boom in Indonesia is sure to have a significant impact on, it would be the growth of entrepreneurship. Indonesia is one of the most smartphone-savvy and social media crazy countries in the world and the start-up industry has already stirred up, with several niche companies aiming to leverage on the expanding consumer class which is ever more connected.

Several tech start-ups have ventured into the food delivery business. While some of them operate a more sophisticated online catering business, some other merely act as a platform to connect buyers and sellers (PriyankaShekhawat, 2014).

To be continued to: MARKET SEGMENTATION IN THE ONLINE CATERING INDUSTRY (2)